Payment Agreement Template

Structuring Financial Obligations With a Payment Agreement

A Payment Agreement is a vital document that establishes the terms under which one party will pay another, either for goods, services, or loan repayments. It provides a clear framework for financial transactions, outlining the amount, payment schedule, and conditions, thereby preventing misunderstandings and disputes. This agreement is crucial for ensuring transparency and maintaining trust between parties in any financial arrangement.

What is a Payment Agreement Template?

A Payment Agreement template is a structured guide that helps individuals and businesses establish clear financial obligations:

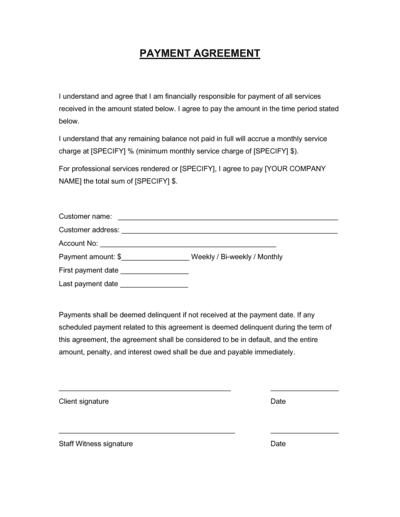

- Parties Involved - Specifies the names and contact information of the payer and the payee, clearly identifying the parties responsible for the agreement.

- Payment Terms - Outlines the total amount to be paid, including details such as payment frequency, due dates, and the method of payment.

- Interest and Penalties - Specifies any interest charges or penalties applicable in case of late or missed payments, ensuring accountability.

- Payment Schedule - Provides a timeline for payments, detailing installment amounts and the total duration of the agreement.

- Purpose of Payment - Clearly defines the purpose for which the payment is being made, ensuring mutual understanding.

- Default and Remedies - Details the steps to be taken if a party defaults on the agreement, including potential legal remedies and the resolution process.

- Signatures and Dates - Spaces for the signatures and dates of both parties, validating the agreement.

Supporting Documents for Structuring a Payment Agreement

To enhance the clarity and comprehensiveness of a Payment Agreement, integrating related documents is advisable:

- Invoice - Provides a detailed statement of the goods or services rendered, establishing the basis for the payment agreement.

- Loan Agreement - Outlines the terms and conditions of a loan, specifying the amount borrowed, interest rate, and repayment schedule.

- Promissory Note - A legal document that formalizes a promise to repay a specific amount of money within a defined timeframe.

- Receipts - Evidence of payments made, supporting the tracking and verification of transactions.

Why Use a Comprehensive Payment Agreement Template?

Using a structured template for drafting a Payment Agreement offers significant benefits:

- Clarity and Transparency - Clearly defines financial obligations, reducing misunderstandings between parties.

- Accountability - Provides a basis for tracking payments and ensuring both parties adhere to the agreed terms.

- Legal Compliance - Helps align the agreement with relevant legal standards, reducing the risk of disputes.

- Risk Mitigation - Minimizes the chances of non-payment or default by setting clear consequences for breach of contract.

Adopting a comprehensive Payment Agreement is crucial for ensuring smooth financial transactions. It provides a clear and actionable framework for payment terms, fostering trust and transparency in business relationships.

Updated in May 2024