Cashflow Forecast_Monthly Template

Understanding a Cash Flow Forecast

In the fast-paced world of business, maintaining a robust understanding of financial health is paramount for sustainable growth and strategic decision-making. A Cash Flow Forecast is a fundamental tool that provides a structured analysis of the expected inflows and outflows of cash within a business over a specified period, offering insights into the organization’s liquidity, solvency, and operational efficiency.

This forecast is crucial for predicting financial positions, planning for future investments, managing debt, and ensuring adequate cash reserves to cover operational needs. It not only assists in anticipating potential shortfalls or surpluses but also supports effective capital management by aligning income and expenditures to strategic business objectives. This document transcends simple budgeting; it is about enabling proactive financial management that supports agility and strategic foresight in business operations.

What is a Cash Flow Forecast Template?

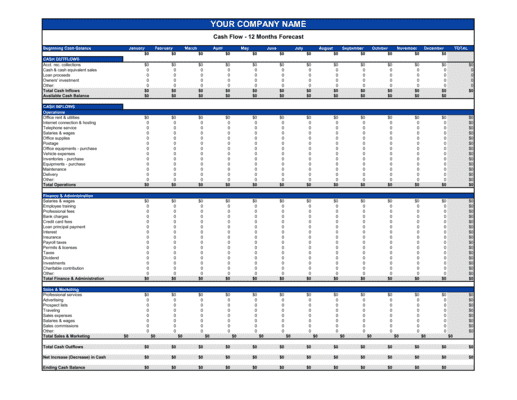

A Cash Flow Forecast template serves as a comprehensive guide that spells out the critical components necessary for projecting future financial flows. This includes detailed sections for categorizing different types of cash inflows and outflows, such as operational revenues, investment activities, and financing transactions. Employing a template ensures a systematic approach to financial forecasting, allowing customization to reflect the unique financial cycles of the business while promoting a clear, mutual understanding of expected financial conditions.

Key Elements of a Cash Flow Forecast

A robust Cash Flow Forecast should thoroughly address:

- Projection Period - Defines the time frame for the forecast, typically ranging from a month, quarter, or year.

- Cash Inflows - Details all expected receipts, including sales revenues, returns on investments, loans, and other income sources.

- Cash Outflows - Outlines all anticipated payments, such as operating expenses, capital expenditures, debt repayments, and purchase of inventory.

- Net Cash Flow - Calculates the net change in cash by subtracting total outflows from total inflows for each period.

- Opening and Closing Balances - Starts with the opening cash balance and ends with the closing balance for each period, providing a snapshot of liquidity at the start and end.

- Assumptions - Lists any assumptions made during the forecasting process, providing context for the projections and any expected variances.

Supporting Documents for Structuring a Paid Time Off Policy

To enhance the accuracy and comprehensiveness of a Cash Flow Forecast, integrating related documents is advisable:

- Budget Planner - Analyzes financial performance by comparing forecasted figures with actual outcomes, identifying discrepancies, and enabling adjustments to enhance future financial planning.

- Financial Report - Provides deeper insights into financial performance, supplementing the cash flow forecast with profitability, liquidity, and solvency ratios.

- Business Plan - Aligns the cash flow forecast with the broader strategic goals outlined in the business plan, ensuring financial activities support overall business objectives.

- Annual Report - Provides a comprehensive overview of the company's financial status, including income, expenses, and debt obligations, essential for informed decision-making and strategic financial planning.

Why Employ a Detailed Template for a Cash Flow Forecast?

Utilizing a detailed template for drafting your Cash Flow Forecast offers significant benefits:

- Financial Clarity - Provides a clear and detailed view of future cash positions, essential for effective financial planning and risk management.

- Strategic Decision-Making - Supports informed decision-making regarding investments, expenses, and financing strategies based on projected financial data.

- Risk Mitigation - Helps identify potential cash shortages in advance, allowing timely interventions such as arranging additional financing or optimizing operational expenditures.

- Performance Monitoring - Facilitates ongoing monitoring and management of financial performance against strategic goals, promoting financial discipline and foresight.

Adopting a comprehensive Cash Flow Forecast is essential for businesses aiming to navigate the complexities of financial management effectively. It provides a clear, actionable overview of expected cash movements, ensuring that the business remains well-prepared to meet its financial obligations and capitalize on opportunities as they arise.

Updated in April 2024